A Real Feeling of Security: meditations on success in 'retirement'

This is Part 2 of a 5 part series. To see the whole series, read the introductory post.

Security is a relative concept. We all want to feel safe, whether that be as we walk through the park, or as we fly through the air in a tin can. Sure we all like to take risks, but for most of us, the thrill of those risks is all the more enjoyable when we know that we can’t really get hurt. Financial security is just the same. We all want to be part of the 1% of the 1%, but our willingness to risk everything for some small chance to acheive that is probably pretty low. Faye and I have discovered about ourselves that, in the absence of a pension, weknowing that will be able to enjoy our ‘retirement’ is key to both our future, but also our satisfaction with our financial today.

We are not, by any stretch of the imagination, willing to put ourselves deep into consumer debt to ‘enjoy today’. We are not willing to bank on the fact that we will ‘save more’ later, when we have more disposable income. We are not willing to live a ‘retirement lifestyle’ that requires us to scrimp month-to-month because our savings weren’t sufficient. Knowing that we’ll have a safe retirement is a requirement of enjoying our money today. While this may seem like a bit of a duplicate of Our Third Pillar, it is a fundamentally different force. In Our Third Pillar, we are looking for consistent cash flow to minimize the strain on our relationship. This is maximizing our capital to ensure a passive income.

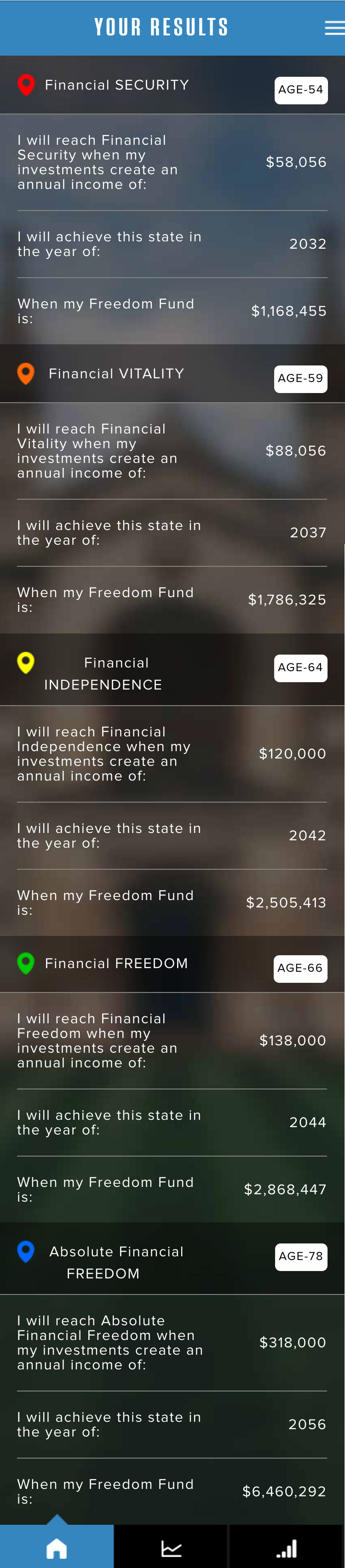

Passive is the key here because at a certain point, neither of us is going to want to working day-in-day-out. At that point, we don’t want to have to rely on drawing down our capital in order to survive. A nest egg big enough for that would be very difficult to accomplish. Rather, we want to know that we have a sufficent capital base that we can put that base to work and live on the return (i.e. the interest). Tony Robbins has an excellent way of looking at this. How big does your nest egg have to be, so that your investment income can give you Financial Security, Vitality, Independence, Freedom or Absolute Freedom. We’ve set a goal for ourselves of Freedom, because we want to live a secure, happy, free old age.

Retirement at this point in our lives only means that point at which our activies are completely separate from our income. Up until that point, there is always some correlation between how hard/often/long your work, and the amount of revenue you see. Retirement for us is the point at which we an do whatever we want and not have to concern ourselves with how to buy groceries. It doesn’t mean we’re not active( remember Ironman at 70), it means we’re free.